Lots of people in India want to buy land, especially investors from big cities as land is a scarce commodity and it sounds amazing to build your own house on a piece of land instead of staying in apartments.

However, do remember that there are no specific loans available to buy agricultural land. The only loans available to buy the plot are for “residential plots”, which means that if you take these “plot loans”, you need to also construct a house within 2-3 yrs of buying the plot. You can’t just buy a residential plot and skip building the house.

However, many people do that. Some intentionally and some out of ignorance.

- What exactly happens when you dont build the house on a plot taking on a loan?

- Is there a penalty?

- Can there be any actions against you?

What happens if you dont build the house on the plot?

When you take a plot loan, it comes at a lower interest rate because the assumption is that you will be building the house on that land within 2-3 yrs. But if you fail to do that and dont submit the required documents (completion certificate) to the lender on time, your loan will be converted to a normal loan and the interest rates will be increased by 2-3% with a retrospective starting date as per the agreement between you and the lender.

This means that your loan outstanding amount will go up by some amount due to this change and you will have to now pay that additional amount. At the end of 3 yrs, the bank will ask you for the proofs of construction, and if you fail to submit them, you will have to pay an additional amount.

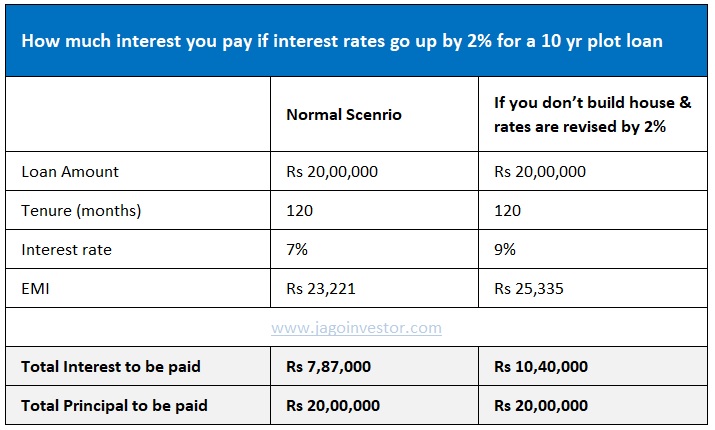

Here is an example of a Rs 20 lacs plot loan which is taken for 10 yrs @7% interest rate. The interest to be paid in this case will be 7.87 lacs apart form the 20 lacs principal amount.

Now if the interest rates are revised to 9% (2% increase) the interest, in this case, will increase to 10.4 lacs, which is 2.53 lacs more than the original amount.

Is there a single loan for plot and house cost?

Some banks like SBI (as told to me by a representative) first issue a plot loan and then after 2-3 yrs issue another home loan for the purpose of constructing the house (two separate loan account numbers), whereas some banks may issue a single loan itself for both purposes and it will be mentioned in the agreement (for example 40% amount is for plot and 60% for house construction). Note that you can avail of 80C benefits as these loans are issued as home loans (the part of the loan which will be used for house construction).

Wrong information given by the bank representatives

Many times you may get wrong and misleading information from the bank representative. They may tell you that “Nothing will happen after 3 yrs, dont worry” or “These are all just formalities..” mainly because he is interested in getting the loan approved due to their targets. This is wrong and makes sure you dont believe them. Always rely on what is written in the agreement.

Note that the loans are given at a cheaper rate for plots because there is a bigger agenda of RBI and govt that everyone shall access to housing. If you are buying the residential plot simply because you can sell it off in future for profits then you cant get the benefit of the lower interest rates.

For you, the interest rates will be revised because you will have to construct a house on the plot after 2-3 yrs as per rules.

Some features of plot loan

- The age requirement is between 18-70 yrs.

- A CIBIL Score of 650 or above is required (in most cases)

- Up to 60% to 70% of the property price is given as a loan depending on the bank.

- These loans are given for a maximum of 15 yrs tenure

Points to remember before going for the plot loan

Make sure you take these plot loans only in case you are really interested in building the house. You can also ask the bank to first disburse only the loan amount for the plot and later release more amount at the time of house construction. It’s really not worth playing around with bank and playing tricks as it will mostly waste your time and you won’t gain much in case you dont want to build the house.

Also, here is a checklist before buying a plot in India in case you are planning to buy one!

Do let us know if you have any questions