Best Broker For Option Selling In India-2022

In this article, I’ll share the list of best stock broker for options trading in India. Options are important to hedge investment, which control loss if stock goes in opposite direction.Many traders earn money exclusively with options without hedging.

Success of options traders, depends on many factors, one of the major factor is your stock broker.With your strategies and investment, need to get concurrent from the trading platform you are using, which stock broker provides.

During this article ,let’s dive deep into multiple aspects and conclude which broker to choose for options trading in India. AliceBlue?

Unlike normal equity and F&O trading,Options trading require different ways of services from Stock Broker.I will be formatting clearly to make your choice wise.

“Theta Decay”, very frequently used term, you may be knowing if you have little experience in options trading, if you are a fresher ,do not trade in Options without knowing the unknown facts of “Theta Decay”.

This Theta Decay is hurdle if you want to make money in a long run ,if you are a “Option Buyer”,we will not go into options buyer in this article, as we focus majorly on option selling and best stock broker for option seller.

On paper, option seller has “unlimited loss” possibility, with experience into options trading ,traders make thier way to book profits infact good profits.

Interested to look into options basics, here we are:

Point to note Option Selling is also called as Options Writing,Options Shorting.

If you are new to trading world and looking for free research recommendations?

I recommend going for Angel Broking, Install Angel Broking app and get started.

Options Trading

Options means a contract between two parties to buy or sell any listed shares at an agreed price or at a price running with a timeline usually weekly and monthly available in the India Market.

Options can be bought or sold on a pre-defined quantity called a “lot”.Lot quantity is defined by Stock Exchange.Each stock will have different lot size based on the price of the stock.

Example:if we choose SBI stock,If futures and options SBIN has lot size of “1500”,means at a time you can buy multiples of 1500 quality only.In equity, you can buy even 1 quantity also.

Options to have basic understanding ,options will have Call and Put or can term as Call Option and Put Option.Will cut here about options, and will publish dedicated articles on Options.If you are a regular trader, then choosing best broker for options day trading helps you in trading

Challenge For Option Sellers About Deep OTM Options

True ,I agree 100% ,as I was one who did research to find the best broker who allow narrow strike price or Deep OTM.

All stock brokers do not allow deep OTM(Out of the Money) options by default, then which broker allows Deep OTM options? I found answer with AliceBlue, which allows deep strike price and Angel Broking.

But deep OTM strike price are not allowed by default, you need to send an email request every time new contract opens at Alice Blue.

But at Angel broking, you get deep OTM access soon as you open a free trading account at Angel Broking

If you are a regular option sellers, then sending an email request once in a month is enough to get Deep OTM strike price access at AliceBlue.

Below picture gives Overview about ATM,ITM,OTM

When Option sellers place order, far from current strike price ,then usually get error “strike price is outside the allowed range” in Upstox also, as you cannot trade on all strike prices, trade should be taken at strike price which is near to the present running price.If you want trade output the strike price range, then I recommend AliceBlue.

Features to Consider Before Opening Trading Account For Options Selling

With multiple stock brokers in the Indian Market from small to big,Initially need to check whether they are registered brokers with stock exchange, which is a very basic check, you can see registration details on thier websites.With that said, let me move into key features to focus :

1.Brokerage

2.Charting Software/Platform

3.Leverage Or Margin

4.Trading Apps

Brokerage

Brokerage charges are major deduction in our P& L Statement, you observe with all stock brokers, they charge for the service they are offering.

Important to check the services and brokerage they are charging are worth enough.

Each broker have thier own brokerage plans, like some stock brokers charge per each transaction, some charge for each lot and some charge a flat brokerage charges, it is required to calculate the brokerage charges of each model.

Usually flat brokerage charges are cheaper in most of the time.Still brokerage calculation gives you an estimate of the deductions.

All stock brokers charge brokerage ,whether is is profit or loss,But stoxkart, a renowned stock broker ,charge brokerage only if you are in profit, this approach saves some bucks if you are in loss in any of your trades.

Click Here, to choose Stoxkart as you Stock Broker, to save some money on brokerage.

Charting Software

Choosing best stock trader based on brokerage is not enough, also required to see the trading software, stock broker is offering to user.

Charting is the key to learn and identify important levels with advanced indicators.

Click Here >> to choose stock broker with best charting Software.

Margin/Leverage

For option sellers, leverage plays a major role to decide on the investment requirements, most of the times options sellers use to hold for more then a day ,which is called holding.

Leverage is an instrument or a feature, which stock broker will decide, how much investment require to buy any option; Click Here >> to choose highest leverage broker for option selling

Trading Apps

What are the trading platforms your stock broker is offering ,Best trading software used to do technical analysis on the go ,if the stock broker providing mobile platform for trading as almost all brokers are providing these days, but checking quality of mobile app is important.

Trust worthy stock broker will manage trading platforms like mobile application, web application and desktop application, which user can trade from anywhere.

Click Here>> to choose best stock trading software for beginners also.

Best Broker For Option Selling In India

With vast experience in the Indian Stock Market and using different stock brokers for different uses,I rank as below ,if you want to choose best broker for option selling in India

1.Zerodha

2.Upstox

3.AliceBlue

Zerodha

“Zero”-dha, all time favourite for new traders in the stock market.Nithin Kamath, founder of Zerodha, established as a stock broker with “zero” brokerage. Zero brokerage ? Want to open one? Just a minute conditions apply* Zero brokerage on equity (sbin, hdfc etc.,) if you are holding for more than one day, other charges from government will apply. Zerodha is one of the best stock broker best option traders to follow.

They set a trend in the stock market ,which helped to bring down the brokerage charges a lot.Zerodha is a discount brokerage, which they provide services by gives robust trading software.Zerodha is the Largest Stock broker in India surpassing full brokers like Sharekhan.

Brokerage: Zerodha charge flat Rs.20/executed order ,with any number of lots, if holding for delivery(holding for more than a day) then brokerage charges are “zero”

Charting Software/Platform:Offering robust charting software with advanced indicators with utmost accuracy,I love to use charts of Zerodha.

Leverage Or Margin:Leverage/Exposure charges based on market conditions usually 3 to 4 times of actual investment we get from Zerodha.

Trading Apps:Zerodha known for your trading applications like Kite Mobile App,Kite Web Application and Pie Desktop Trading Software.

Pros

Best rated trading platform

Easy charting software with advanced indicators.

Zero brokerage if holding for delivery.

Easy Account Opening process.

Zerodha Brokerage Calculation:

Comparing with Full Service broker like Sharekhan, how much can a Trader in Zerodha saves per year? 40%, 50% ..more than that.

At Sharekhan, they charge Rs.50 per 1 lot, if 10 lots of Nifty purchased in a day, brokerage will be 10 lots*50 rs per lot=10*50=500 rs and foe selling another 500 rs.

Per day ,if you buy and sell Nifty:brokerage charges per day :1000rs.

If doing same trade daily, then per month you need to pay 20000 rs, per month(20 trading Days in month) and yearly 20000*12=2 Lac 40 Thousand as brokerage.Oh No!!!!!!!

At Zerodha, they charge Rs 20 per single transaction, means buying 10 lots at a time will charge 20 rs and selling 10 lots at a time will charge another 20 rs, means per day 40 rs.

Per Day:40 Rs

Per Month:20(20 trading days)*40=800 rs

Per year:12*800= 9600 rs.

Congratulations !! You save almost 90%+ on brokerage per year, if you are using Zerodha as your stock broker.

Open Trading Account with Zerodha and save upto 90% of brokerage compared to full service brokers.

Upstox

RKSV Securities ,rebranded as Upstox, which is Mumbai based discount broker ,now competing with Zerodha by increasing the client base with best services and improving day by day to each the user experience.

Brokerage:Upstox brokerage charges same as its competitor with Rs 20 flat per transaction, offering free brokerage for delivery.

Charting Software/Platform:Comparing with competitor, Upstox continuously updating to reach to the advanced level of charting with best indicators.

Leverage Or Margin:Upstox added something here, if user want more leverage upto 4 times, trade have option to choose Priority plans with Rs 30/transaction.If basic plan, will get upto 3 times margin.

Trading Apps:Upstox offers trading software with branding as Upstox pro, can get this with mobile and web application and offers Nest as a desktop application software.

Brokerage Calculation :

Upstox brokerage calculation is identical as Zerodha, you will get same savings as its competitor.

Pros

Option to choose higher leverage option

Free Account opening

100% Online Account Opening

Cons

Call and Trades are chargeable.

GTC not compatible with Delivery Trades.

Aliceblue

Aliceblue, which is Chennai based discount broker ,front runner after Zerodha and Upstox to choose .Aliceblue now focussing on decreasing the brokerage of the traders to make trading nearer to the common man ,beside offering cheap brokerage,it also provides most advanced trading platform.

Brokerage:Aliceblue charges from Rs.15 per transaction ,less brokerage when compared to the competitors with free brokerage for delivery.Open Free Aliceblue Account

Charting Platform:Aliceblue is best for providing advanced charting with easy trading options and making the charts and indicators more advanced.

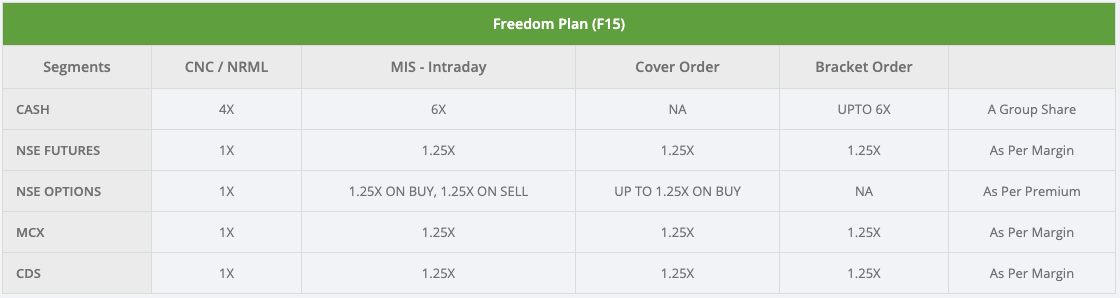

Leverage Or Margin:Aliceblue designed a dedicated plan ,if traders want more leverage with Freedom Plan.

Trading Apps: For trading live, Aliceblue offers software name as “ANT”, can get this with mobile and web application and offers “ANT mobi” which is a mobile app for trading on mobile.

Brokerage Calculation :

Aliceblue brokerage calculation will give more saving than its competitors like Zerodha and Upstox , you get more savings with Aliceblue.

Pros

Option to choose higher leverage option

Free Account opening

100% Online Account Opening

Less Brokerage

Cons

Call and Trades are chargeable.

Poor Customer Service

Conclusion

With so many brokers out there in the Indian stock market, each broker have thier own preferences for performing thier operations.

If you are an option seller and want to trade deep out of the money options then I recommend AliceBlue and Angel Broking.

Free account opening available using this exclusive link at Aliceblue and exclusive link for Angel Broking

Questions? Let us know:

Copyright 2021, Capitalgreen.in- Disclaimer