The discount rate is nothing but our minimum expected rate of return from an investment. The concept of discount rate is used to calculate the present value of future cash flows originating from an investment.

Why do we need to calculate the present value? It is a method to check if an investment is worth indulging in or not. How to do it? This can be done in three steps.

Step one is the estimation of future cash flows. The second step is estimating the right discount rate (minimum expected return). Step three is the calculation of the present value.

In these three steps, it is essential to estimate the right discount rate. Because only then a correct present value will emerge.

People give extra emphasis on the estimation of future cash flows and the calculation of present values. But the discount rate gets ignored. It doesn’t get similar importance.

This article aims to unearth the concept of the discount rate. It will help people to pick a suitable discount rate number for their investment analysis.

See Video: Concept of Discount Rate

The Concept of Discount Rate

One can do an investment evaluation from the perspective of two individuals. The first is a retail investor, and the second is a businessman. These two individuals will comprehend the discount rate differently for their investment analysis. Let’s understand why?

An Investor

As we have seen, the discount rate is nothing but one’s minimum expected rate of return. Before committing to an investment, an investor has two choices. He/she can either invest in a risk-free option or will invest elsewhere. To understand the thought process of an investor, check the below infographic.

The risk-free option will provide a minimum rate of return to the investor. Hence it becomes his discount rate. The investor will then use this discount rate to do a present value analysis of other investments (like stocks and real estate)

A Businessman

For a businessman, investment decision making is more complex. Venturing into the business will make sense only if the returns generated from it would be more than the cost of capital (WACC). To understand the thought process of a businessman, check the below infographic.

Depending upon the proportion of equity and loan in the total capital required for starting a business, its cost of capital (WACC) can be calculated. How to cover this cost? It will come from business (profits).

WACC is kind of a break-even profit margin a business must yield to keep it floating. Hence it becomes the discount rate for the businessman. This rate is then used to do a present value analysis of all estimated future cash flows of the business.

Let’s understand it better using a video and few examples.

Examples of Discount Rate

To better understand the concept of the discount rate, we will take an example and evaluate it from two perspectives. First, of an investor and second of a businessman.

#1. Investors Perspective

In this example, we will see an investment where lump-sum money is put-in to buy shares. The shares will yield future cash flows as dividends for 5 years, and capital appreciation in the fifth year.

For this investment, we need to do a value analysis to check if this investment is worth investing in. How to do it? First, we have to create a reference. This reference will become our “risk-free rate”.

One of the easiest ways to pick risk free rate is to check the return generated by a 5 star rated debt mutual fund in the last 5 years. In the present context (post covid), our risk-free return number will be about 7.5% per annum.

Now we can do two (2) things:

First

We can calculate the present value of future cash-flows at a discount rate of 7.5% per annum. To calculate the present value, we can use the PV formula of Excel.

In our example, at a discount rate of 7.5%, the total present value of future cash flows is coming as Rs.1,28,743. This value is higher than the invested value of Rs.1,00,000, it means the cash flows are at least meeting the minimum criteria of 7.5%. It is a good thing.

Second

We must do the iteration to find at what discount rate, the total present value of all future cash flows will become Rs.1,00,000 (equivalent to the invested amount).

I have done this iteration. It was found that at 13.237% per annum, the total present value becomes equal to the invested amount.

What does it signify? It is an indication that, if the present cash flows hold, the maximum return this investment can generate is 13.237% per annum.

#2. Businessman’s Perspective

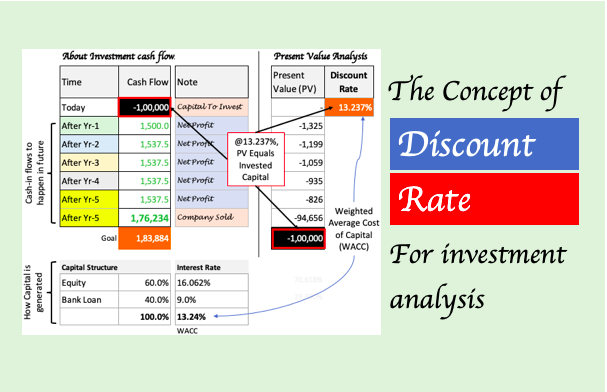

Let’s check the same example from the perspective of a business-like venture. Suppose there is a business prospect that requires Rs.1,00,000 as capital. Upon investing this capital (for land, building, other assets), the business will generate cash flows (profits) for the next 5 years as shown below:

The capital structure of this business venture is 60% equity and 40% bank loan. The return expectation of shareholders (equity) from this investment is 16.062% per annum, and interest on the loan is 9.02% per annum. This way the weighted average cost of capital (WACC) of this business venture will be 13.24% (=60% x 16.062% + 40% x 9.0%).

The WACC of 13.24% will become the Discount Rate to analyze future cash flows of the business. How to do the analysis? By calculating the Present Value (PV) of the future cash flows using the PV formula of Excel.

If the total PV calculated is more than or equal to the invested capital (Rs.1,00,000), it means the business venture is good for consideration. Here is the working of PV calculated in excel:

What inference we can draw from these numbers? It states that, if the business generates the said cash flows in the next 5 years, it is capable of sustaining its cost of capital (WACC) of 13.24%.

Conclusion

To best understand the utility of Discount Rate, readers must also know about the concept of Present Value. This is another subject altogether. But for the moment we can remember that no present value calculation (value investing) can yield the right numbers without a correct discount rate.

Please remember that the discount rate estimation is a science on its own. But this does not refrain us from at least guessing a near right number for it. How to do it? This is what has been explained in this article.

I hope you liked the examples (one and two) and the video used to explain the topic.

Please leave a feedback in the comment section below.