Do you want to invest your money in the stock market? Are you looking for the best stock broker in India? Are you wondering about the Upstox 3 in 1 account? Do you want Upstox 3 in 1 account review? If your answers are yes, then this article is exclusively for you.

Upstox is a top stockbroker in India, which was previously known as RKSV securities. Upstox is best for traders because it provides low brokerage, high margins, and a decent trading platform.

Upstox is a safe stock broker for your investment as it was funded by Ratan Tata, Kalaari Capital, and GVK Davix. Recently the company has launched Upstox 3 in 1 account for the investor in March 2020 in collaboration with Indusind.

Alternative Options for Upstox:

Read detailed information on best broker for option selling

Differences Between 3 in 1 Account and 2 in 1 Account?

Do you know the meaning of 3 in 1 account and 2 in 1 account? Upstox has recently launched 3 in 1 service, which means this account provides the benefit of trading, Demat, and bank account in one account.

2 in 1 account also gives you a platform to invest your money in the stock market. But, it only provides the benefit of trading and Demat accounts to its users. The only difference between these two accounts is the inclusion of a bank account in the 3 in 1 package.

Steps to Open Upstox 3 in 1 Account

If you have idle money and want to invest in the stock market, then it is better to open your account in Upstox. As we are facing the COVID-19 crisis, we must stay in our homes unless it is an emergency.

Thus, looking at the crisis Upstox allows you to open your 3 in 1 account through online and offline methods. You can open your account sitting on your sofa at your desired time.

But, you must have an Aadhaar card and the linked mobile number to authenticate the application form. If you have no mobile linked Aadhaar card, then you must visit the office to open your account.

Here are the lists of documents you will require to open your account.

1. Pan Card

2. Aadhaar Card

3. Specimen Signature

4. Passport-Size Photo

5. Income Proof

Upstox 3 in 1 Account Opening Procedure

Followings are the steps you need to follow to open your Upstox 3 in 1 account:

1. Sign Up

The first step to open your Upstox account is to sign up on the Upstox homepage. Go to the official website of the company, and click on start Investing.

After clicking, you will go to the next window, where you need to sign up for opening an online Demat and trading account.

2. Verify Your Mobile

The second step is to verify your mobile with OTP. So, you need to provide your mobile number and email address.

After providing valid information, an OTP will be sent to your mobile number to authenticate the mobile number. After authenticating your mobile number, you can move to the next step, where you need to provide your details.

3. Provide Personal Details

In this step, you need to provide your details like marital status, yearly income, trading experience, etc. You need to select the options rather than filling all the details.

After providing the personal details, read the taxpayer declaration, and check on the declaration box. Now, click on the Next tab to proceed ahead with the application steps.

4. Select Trading Experience

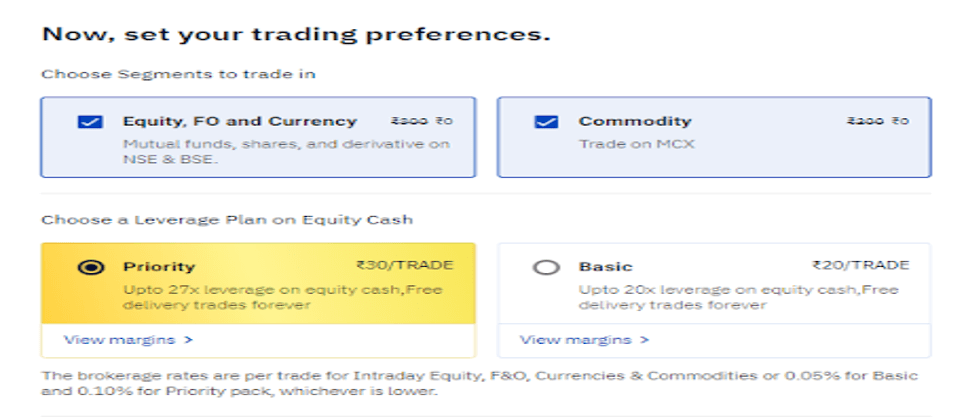

Now, you need to clarify your trading experience. Upstox gives you an option to select the segment in which you want to trade. You can select all the segments, or either you can go for First Set or the Second set as per your experience.

If you are a new investor, please go for the first set only. Now, you have the option to choose a brokerage plan. You can select a Priority brokerage plan or Basic brokerage plan as per your requirements.

5. Enter Your Bank Details

You need to provide your bank details like account number and the IFSC code. Never add a payment bank because Upstox does not support the payment banks like Paytm.

You need to provide valid bank details to link your trading accounts so that you can comfortably send funds to your trading account. Upstox never shares your account information with others, and they encrypt all the transactions to provide maximum security.

6. Authenticate Your Application Using Aadhaar Card

In this step, you need to authenticate your application using the OTP number. You must have an Aadhaar card to process your online application.

If you don’t have an Aadhaar card linked to your account, then you need to visit the office to open your account. To avoid the offline Demat application method, link your Aadhaar card to your valid number.

7. Upload the KYC Documents

Now, this is the last step of the application process. In this process, you need to upload a copy of all the KYC documents and the image of your signature and photographs.

After uploading your KYC documents, now your account will be live within 48 hours. You will get your login Id and the password of your trading account.

Upstox 3 in 1 Account Plans and Pricing

Upstox 3 in 1 account plans and pricing are appropriate and affordable. In today’s context, Upstox has over 4 million users all over India.

If we talk about the account opening cost and charges, Upstox does not involve any extra charges. The company charges zero brokerage fee for equity deliveries.

You may be charged INR 20 per order or 0.01% (whichever is lower) for equity intraday trading. This condition applies to both Buy and Sell orders.

If you want to trade in futures, it will charge you INR 20 or 0.01% per order. For options trading, you need to pay INR 20 per order.

Upstox Annual Charges

Upstox has an affordable opening and annual charges. Here are the details about its opening and annual charges:

a. Upstox charges INR 299 for Demat and trading account.

b. Upstox charges INR 25 per month excluding GST to maintain your Demat account

Pros of Upstox 3 in 1 Account

Why do you need to choose Upstox 3 in 1 account though there are many other options available? Do you have this question roaming in your mind? If yes, I am going to explain to you the key benefits of this account.

Here are the top five benefits of using Upstox 3 in 1 account.

1. Low Brokerage Cost

Upstox charges INR 20 brokerage fee under the Basic Plan. That means you can cost-effectively trade large volumes.

The new investor who is on a budget, but wants to try with stock intraday trading will get a lot of benefit from the flat charges. If you are an intermediate trader with 6+ months of trading experience, then go with the Priority Plan.

Under Priority Plan, you may need to pay INR 30, which is very much cheaper compared to other full-service brokers. Other popular stock brokers may charge a 0.50% brokerage fee.

2. Appropriate Plans and Pricing

Upstox has satisfying plans and pricing compared to other companies. Its main motto is to give a world-class stock trading experience to the traders at affordable pricing.

You may have to pay INR 299 for opening a Demat and trading account. Sign up as soon as possible because you may enjoy an offer of INR 1000 brokerage credit on account opening.

Upstox also charges a fee to maintain your account. You need to pay INR 25 every month for maintenance charges.

3. Good Trading Margins

Margins allow you to trade multiple times of the money available to you. For example, if you have INR 1000 in your trading account and If you enjoy 10x leverage, then you can open an intraday position worth INR 1,00,000.00.

Under the Basic Plan, Upstox offers 15x margins on intraday equity trading and 20x on the Priority Plan. 15x margins are sufficient to start stock trading for a new trader.

Upstox thinks about your investment and tries to guide you to protect your investment. Thus, the company protects you from the risk of losses by providing decent trading margins.

4. No Need for Minimum Balance

Why are you blocking your money as a minimum balance if Upstox provides a zero balance account? Do not hold your amount. Let your money brings more money for you.

Upstox 3 in 1 account minimum balance is zero. You don’t need to block your money for a minimum balance.

Rather, the company offers different free trading services to its valuable traders to uplift their stock trading careers. Thus, use your money wisely, and choose the best stock broker that thinks about your progress.

5. Easy Transfer Facility

Upstox 3 in 1 account is the combo of Demat+ Trading + Bank account. You can trade without facing the difficulties of transferring funds.

Upstox gives you a comfortable transfer facility to allocate funds for trading. It erases the difficulty of transferring funds between saving and trading accounts.

Thus, Upstox provides a real-time fund transfer facility from the bank account to the trading account without cumbersome authentication.

Cons of Upstox 3 in 1 Account

Upstox 3 in 1 account has very few drawbacks. If something has an advantage, then there must be some disadvantages. As we have discussed the Upstox 3 in 1 account benefits, now let’s talk about its cons:

1. Upstox Does Not Support Payment Bank

Are you thinking of opening 3 in 1 for trading securities? If yes, then you must have a valid bank account.

Upstox only supports valid bank details. It has no option of setting payment bank like Paytm, PhonePe, and so on to load your funds to the trading account.

If you have no bank account, then you must have to create your bank account to be a stock trader.

2. Less Physical Presence

Upstox has its physical office only in Mumbai and Delhi. Upstox is slowly increasing its branches in other top cities of India, but for now, they have expanded only in the two cities.

You cannot visit their office if you have any emergency. You need to rely on their online support.

Their online support is quick and run by the top professional employee. But if you want to visit their office for serious issues, then it’s difficult.

Testimonial

“I had opened my trading account, Demat account, and saving account in the xxx stockbroker company. After that, I had traded stock. But whenever I called them for help, they always ignored me.

They never picked my phone on time and never responded to my message. They always took time for the settlement. Their service was so poor and ridiculous. After a certain time, I came to know about Upstox. I have researched about this company and found excellent reviews.

That’s why I left the xxx company and started trading stock through Upstox. Now, I am thrilled. They have highly trained and professional employees who never feel lazy to handle your issues. Thank you, Upstox for providing us such an excellent platform. “–Kevin Malhotra

FAQ’s

Does Upstox Provide Interest On Trading Account Funds?

> Yes, Upstox gives you 6% interest in your trading account funds. Upstox also gives you an interest in your saving account balance.

Does Upstox have Call N Trade Service?

> Yes, you can place your order via phone for INR 50 per order placed.

What are BTST Orders?

> BTST stands for Buy Today Sell Tomorrow. It is equity delivery trades, and you will pay zero brokerage on these orders.

Conclusion

Thus, Upstox 3 in 1 account provides seamless banking and investment experience to its users. Upstox is an easy and advanced trading platform, which has low brokerage fees and high margins.

Upstox has a stable web, desktop, and mobile trading application that include 100 plus indicators and charting tools. You can start your trading career with no hassle and difficulties.

Hurry! Open your laptop, and visit the official site, and create your accounts. Let your money earns more money for you.