Many people whose income doesn’t fall under tax slab have mostly invested in products such as Fd through which they can earn interest. But can we do anything to make sure that the bank does not deduct TDS on interest earned if our total income is not taxable?

If you all don’t know then let me highlight you that it is mandatory for banks to deduct TDS on our interest income. If our income is not taxable and we also earn interest from other financial products etc..then we will have to provide Form 15G and 15H to the bank so that bank doesn’t deduct TDS since our income is not taxable.

In this article, I will be discussing all aspects related to Form 15 and 15H.

What are Forms 15G and 15H?

Forms 15G/15H are forms that an individual can submit to ensure that the Tax Deducted at Source (TDS) is not deducted on the interest income if she/he meets the applicable conditions. Always remember, that if an individual wants to claim tax deduction through Form 15G/15H, then the individual must have a Permanent Account Number (PAN).

Form 15G is to be filled by individuals aged below 60 yrs and Form 15H is to be filled by senior citizens aged 60 yrs and above. You can click on this link if you want to download the form directly from the website. If you want to have a look of the form, click on the link below,

Eligibility Criteria to fill these Forms –

a) For Form 15G –

- An Individual or HUF or trust or any other assessee

- Only Indian Resident can apply

- Age should be less than 60 years old

- Tax calculated on their Total Income should be nil

- The total interest income for the year should be less than the basic exemption limit of that year

b) For Form 15H –

- A Resident Indian Individual

- Age should be 60 yrs or more (senior citizen) during the year for which you are submitting the form

- Tax calculated on their Total Income should be nil

Who all are not eligible to fill these forms?

The following are not eligible for submission of Form 15G/15H –

- Company (Private and Public)

- Partnership Firm

- Non-Resident Indian (NRI)

- An Individual whose estimated total income or the aggregate total income exceeds the basic exemption limit.

Can these forms be filled online or just offline?

a) Form 15G (online and offline) –

An individual can choose to submit Form 15G offline or online, depending on the facilities provided by their bank or financier. Firstly they need to check if their bank allows submission of Form 15G online. If this facility is available in their bank, they can simply log on to their internet banking account and fill-up the form online. Once you have filled up the form, recheck the details, and hit submit. For your future reference, you can download the submitted form.

The other option is to fill a physical form and submit it to the bank. The forms are available in the Income Tax Portal. You can download the form and get print outs of the same. You can then submit these duly signed documents to the bank or financier where you have the savings accounts. You can also submit it at the post office or the company you work for depending on your requirement.

Currently, there are 2 banks that provide online filling of the forms. If you have an account in below 2 banks then you log in through internet banking and fill these forms –

b) Form 15H (online and offline) –

You can submit Form 15H online or offline mode both. To submit it offline, you need to download the form from the Income Tax portal as discussed above. Once you have completed filling the form, you can submit these forms at your bank or post office or your employer (in case of Provident fund).

If your bank or financier allows submission of Form 15H online, you can log on to your internet banking and fill-up the form. You can submit the form directly using internet banking. For your future reference, you can download the submitted form.

Currently, there are 2 banks that provide online filling of the forms. If you have an account in below 2 banks then you log in through internet banking and fill these forms –

A detailed guide on how to fill the form through SBI Internet Banking –

https://www.youtube.com/watch?v=caaPCf_QF3Q

Different other scenarios where these forms can be utilized –

a) TDS on EPF withdrawal –

TDS is deducted on EPF balance if it is withdrawn before 5 years of continuous service. If an individual had less than 5 years of service and plans to withdraw their EPF balance of more than Rs.50,000, then they can submit Form 15G or Form15H. However, to fill this form the tax on an individual’s total income including EPF balance withdrawn should be nil.

b) TDS on income from Corporate Bonds –

If an individual holds corporate bonds, then TDS is deducted on them if their income from these bonds exceeds Rs 5,000. They can submit Form 15G or Form 15H to the issuer requesting the non-deduction of TDS.

c) TDS on post office deposits –

Post offices that are digitized also deduct TDS and accept Form 15G or Form 15H, if an individual meets the conditions applicable for submitting them.

d) TDS on Rent –

TDS is deducted on rent exceeding Rs 2.4 lakh annually. If the tax on an individual’s total income is nil, then they can submit Form 15G or Form 15H to request the tenant to not deduct TDS.

e) TDS on Insurance Commission –

TDS is deducted on insurance commission if it exceeds Rs 15000 per financial year. However, insurance agents can submit Form 15G/Form 15H for non-deduction of TDS if the tax on their total income is nil.

FAQs –

i) What will happen if I forget to submit the form on time to the bank?

If you forget to submit these forms on time then the bank will deduct the TDS. However, one can claim the deducted TDS by filing an ITR.

ii) What is the difference between Form 15G and Form 15H?

Both are self-declaration forms that an individual will have to submit to the bank once they open a fixed deposit. While Form 15G is for those who are below 60 years and come under Hindu Undivided Families (HUF), Form 15H is for everyone who is 60 years and above.

iii) Is the form provided by banks one and the same from? Or is it different?

The forms which banks provide are a little different from the actual form which is available on the income tax website. However, both type of forms serves the same purpose. You can have a look at the form in the above section.

iv) Can HUF, NRIs submit Form 15G/Form15H?

HUF can submit Form 15G if it meets the conditions but Form 15H is only for individuals. NRIs cannot submit Form 15G or Form 15H. These can only be submitted by resident Indians.

v) Do I need to submit Form 15G/ Form 15H at all the branches of the bank?

Yes, you must submit one at each branch of the bank from which you receive interest income though TDS is deducted only when total interest earned from all branches exceeds Rs 10,000.

vi) Does filing Form 15G/Form15H mean my interest income is not taxable?

Form 15G/Form 15H is only a declaration that no TDS should be deducted on your interest income since tax on your total income is nil. Interest income from fixed deposits, recurring deposits, and corporate bonds is always taxable.

vii) Will my interest income become tax-free if I submit Form 15G/Form15H?

Interest income from fixed deposits and recurring deposits is taxable. For senior citizens deduction of Rs.50,000 is available under section 80TTB for the interest income from fixed deposits/post office deposits/deposits held in a co-operative society. You should submit this form only if the tax on your total income is zero along with other conditions.

viii) I have submitted Form 15G and Form 15H but I also have taxable income, What should I do?

You must inform your bank that tax on your total income is not zero. The bank will make changes and deduct TDS accordingly. You should report the entire interest income in your tax return and pay tax on it as applicable.

ix) Do I have to submit this form to the income tax department?

You don’t need to submit these forms directly to the income tax department. Just submit them to the deductor, and they will prepare and submit these forms to the income tax department. At times these forms can also be filled and submitted in the bank.

x) Is there any time limit for submitting these forms?

There is no time limit or due date for submitting Form 15G/15H to the bank. However, it is advisable to submit it at the beginning of the financial year (i.e. Apr 01) or as and when the new deposit is created.

xi) What is the time limit during which these forms are valid?

Forms 15G/15H are valid for one financial year ending on Mar 31 of every year. So, you will have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure that no deduction is done on any interest income earned.

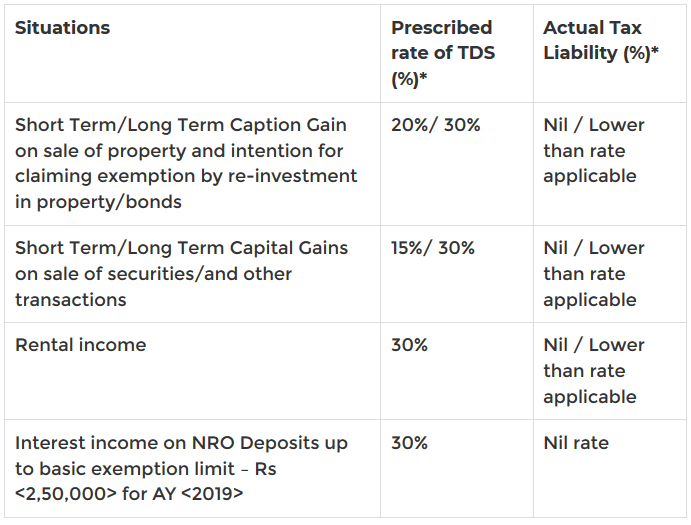

xii) Is there any other way NRIs can refrain from TDS deduction as they are not eligible for Form 15G and 15H?

For any NRI, whose TDS is more than his/her tax liability, such excess tax can be claimed as a refund from the Indian Tax Department (ITD) by filing the Return of Income in the particular Financial Year. Such excess TDS results in loss to NRI due to the time interval between the tax deducted and refund of such excess tax, which may take generally 1 to 2 years.

In order to address the above situation, a procedure has been prescribed under the Act, whereby NRI recipient of income can apply online to ITD (in a prescribed format) along with the relevant supporting documents to issue a Tax Exemption Certificate (TEC) authorizing the payer of income (who deducts tax) to deduct tax at a lower rate or Nil rate, as the case may be.

In the case of NRIs, whose actual tax liability is lower than the rate of tax prescribed under the Act, it is beneficial to obtain a TEC. An NRI should apply for TEC under few situations listed below –

Procedure – The Jurisdictional Assessing Officer (from the International taxation ward of the ITD) of an NRI generally issues a TEC between 2 to 4 weeks from the date of application.

Validity – TEC is normally valid for the period for which such TEC is obtained (i.e. a Financial Year) and for the specific income as stated in the TEC.

Filing Return of Income – NRI who has obtained the TEC has to compulsorily file his Return of Income in India for that Financial Year.

xiii) How can an individual make use of these forms?

These forms can be used only if the tax calculated on the individual’s total income is nil for the financial year. Both forms – Form 15G and Form 15H – have a validity of one financial year. That is why either of them is required to be submitted at least once every financial year. Forms 15G and 15H are basically submitted to save TDS on interest income.

For example, Banks deduct TDS on FDs when interest income is more than Rs 10,000 in a financial year. But if the total income is below the taxable limit, then Form 15G and Form 15H have to be submitted to the bank requesting them not to deduct any TDS on the interest.

Points to Remember –

- An individual can only submit Form 15G/15H to a bank with a valid PAN, if an individual doesn’t have a valid PAN then, the tax will be deducted at 20%.

- It is advisable to submit a copy of the PAN card with the cover letter.

- The individual should make sure he/she receives an acknowledgment while submitting Form 15G/15H. This acknowledgment can be kept for future reference.

- Acknowledgment of submission of PAN details is useful if a dispute with the bank arises.

- The individual will need to submit the details of the Form 15G/15H submitted by him/her to other banks as well as the interest income amount mentioned in these forms.

- As the individual has submitted his/her PAN, the respective assessing officer will have access to all the information submitted by the individual to other banks and will cross check if there is any incorrect information submitted by the individual or not.

- There is a provision for imprisonment for a minimum of three months if an individual is found to have provided incorrect information in the declaration forms.

A short video on How to Fill these Forms –

a) Form 15G –

b) Form 15H –

Conclusion –

So this was all that I wanted to share in this article. If you have any queries then you can post in the comments section.